When it comes to investing in property, metrics are crucial.

You have to know how much potential profit is involved in a deal to know whether or not to get involved – otherwise it could end up a huge drain on both your time and resources.

You also need to present accurate metrics when you’re looking for money from a lender or attempting to sell a deal to an investor.

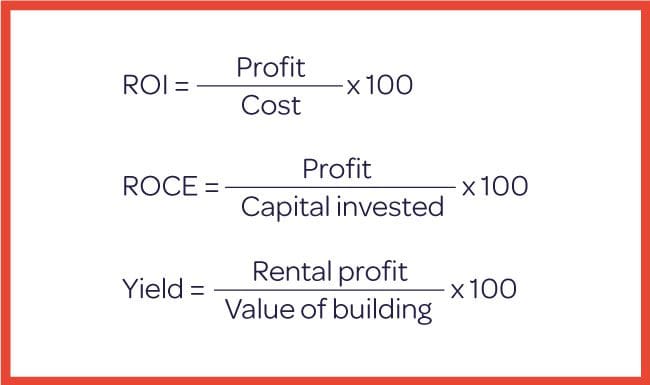

There are various types of metrics used to measure profitability in property. Here at Sourced, we tend to focus on what we consider the three most important. Those are Return on Investment (ROI) and ROCE (Return on Capital Employed), as well as Yield. The latter is specifically for rental properties. Here we give a brief summary of each, together with a brief example.

ROI – Return on Investment

Probably the most common property calculation in terms of working out just how profitable – or not – a deal is. This metric can be used with any property strategy, as it measures what percentage of your investment you are getting back. To work out your ROI, simply take the profit you’ve made on the investment and divide by your costs, then multiply by 100.

Example 1:

- Purchase price: £1,100,000

- Work costs: £300,000

- Mortgage loan: £825,000

- GDV: £1,800,000

- Profit once sold: £232,600

ROI = 15%

ROCE – Return on Capital Employed

ROCE is pretty versatile, similarly to ROI. You can use it even for deals which you are not buying, such as rent to rent. While ROI only looks at the cash you are putting in, ROCE covers the whole capital you are working with, including loans and mortgages. To work out the ROCE of an investment, get the profit from your investment and divide it by the capital you’ve invested in it (ie solicitor’s fees, deposit etc). Multiply that number by 100 to get your percentage ROCE.

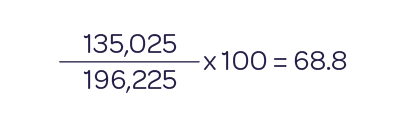

Example 2:

- Purchase price: £325,000

- Mortgage loan: £243,750

- Renovation: £75,000

- ROI: 31%

- Profit: £135,025

- GDV: £575,000

ROCE = 69%

Yield – (for use only with rental property)

The Net Yield of a property is used to help you calculate how much rental profit a property will provide after costs. Gross Yield on the other hand simply informs you of the rental return. This is a simple sum in which you take the annual rental profit and divide it by the value of the building. You then multiple that number by 100 to get the yield.

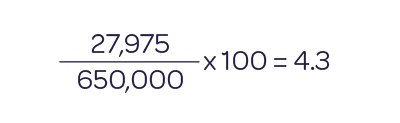

Example 3:

- Purchase price: £510,000

- GDV: £650,000

- Work costs: £53,000

- Annual rent: £48,000

- Annual profit: £27,975

Yield = 4%

Get in touch with Sourced Franchise

If you are interested in making your money work harder for you – and, let’s face it, who isn’t – get in touch with us here at Sourced.

You will discover how to generate at least 30% return on your investment by building a HMO property portfolio.