Financial statements give an overview of a property’s performance, operations, cash flow, and general situation. Investors rely on them to make well-informed decisions on their investments. Often, buyers are hesitant whether to proceed with purchases or wait for property values to decline due to the current economic crisis, given the uncertainty in the property market.

Independent investors often buy houses, fix them up, and then rent them out or sell them for a profit. Any investor will assess the property, determine a reasonable market value and make an offer, taking into consideration market conditions and necessary repairs. Here are the key financials you need to include on every deal:

Purchase Price

The purchase price is the amount paid for an investment and it serves as the investor’s cost basis for determining gain or loss when the investment is sold.

Price is normally determined by comparables, which are similar properties sold recently in the same area.

Rental Income

There are two different rental incomes, gross rental income and net rental income. For the usage of space, money is collected from tenants which is called rental income. You can subtract your rental expenses that may include late fees, laundry machine usage fees, and forfeited deposits (unless credited to rent) from your overall rental income. Rental expenditures are normally deducted in the year in which they are paid.

On the other hand, gross rental income is the total amount you got before any expenses such as insurance, maintenance, taxes, homeowner association fees, and advertising charges were deducted.

Current Value

Based on how the subject property compares to other properties that have previously sold in similar conditions, as well as overall real estate market conditions, such as the amount that a current buyer is willing to pay and the amount that a current seller is willing to sell their home for. The location also become a main factor on how much a property is being sold.

Sourcing Fee

The amount of fees depends on the property sourcer’s level of experience and the amount of work they are putting into the property deal. Usually, property sourcing fees in the UK are around one to five thousand pounds or a minimum of 3% of the purchase price.

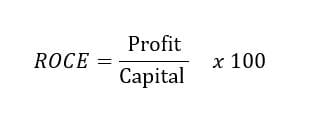

Return of Capital Employed (ROCE)

How you employ the money depends on your property strategy, which will also generate different ROCEs. It is a financial ratio that assesses a company’s profitability in terms of all its capital. You want to be very specific and accurate with the number on your property deals, to build up a level of trust.

Formula to get you ROCE percentage:

How to get the profit?

Total Revenue – Total Expenses = Profit

Profit is calculated by deducting all direct and indirect costs from total money made from a property.

How to get the capital?

Capital is simply all the money you’ve spent on the investment. This may include deposit, solicitor’s fees, surveys, searches, refurb or all of the commitments you have to pay before you get to your profit.

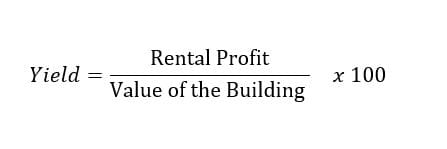

Yield

Yield is only used to calculate the rental return on the property and there are 2 kinds: Gross Yield and Net Yield.

The Gross yield does not take the costs off, so this can be an inaccurate number to show your how much you will earn.

The Net yield, on the other hand, take all of the costs off, giving you a much accurate figure as to how much money you are making.

Yield percentage formula:

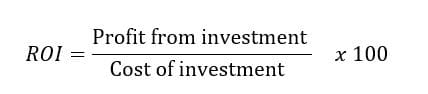

Return On Investment (ROI)

ROI is very frequently used to work out whether a property investment is going to work. It also allows you to compare that property to other investments.

ROI formula percentage:

Profit from the Investment is going to be the resale price, taking away all of the cost which may include deposit, solicitor’s fees, surveys, searches, refurb or all other commitments from the profit.

The cost of investment is then calculated by adding up all of the money you’ve spent and borrowed for that house, including the mortgage loan, bridge, deposit, searches, renovation selling fees etc.

Why is it important to include these different financials on deals you are selling to investors? Investors will know you’re a credible sourcer if you did your due diligence and they can assess if the property is worth buying.

Sourced Network franchisees undergo comprehensive training on property financials and metrics, preparing them to package deals effectively. They also get their deals assessed by their dedicated support people, to make sure they only work on profitable deals. All this help increases their chances of selling if they are focusing on sourcing.

Download our franchise prospectus to discover the full Network package.