Meet Dave, an electrical contractor from Yorkshire, who saw property investment as his key to a better life.

Like many others, he aspired to enter the property market but lacked the necessary support and funding to achieve his goals.

That’s when he found Sourced. With the support and expert guidance, ongoing property training, and access to funding, he’s now deep into two projects that is expected to result in a 6-figure profit. Here’s the details…

Project 1: Full House Refurbishment

Dave discovered the detached 4-bedroom property about 14 months ago, managing to negotiate a good price. Dave is now transforming property, completing a full refurbishment into a 6-bed home by adding 2-bedrooms.

Financials:

Purchased at £265,000 with a build cost of £186,000 plus contingency. The high-spec renovation has a Gross Development Value (GDV) of around £700,000, yielding a six-figure profit.

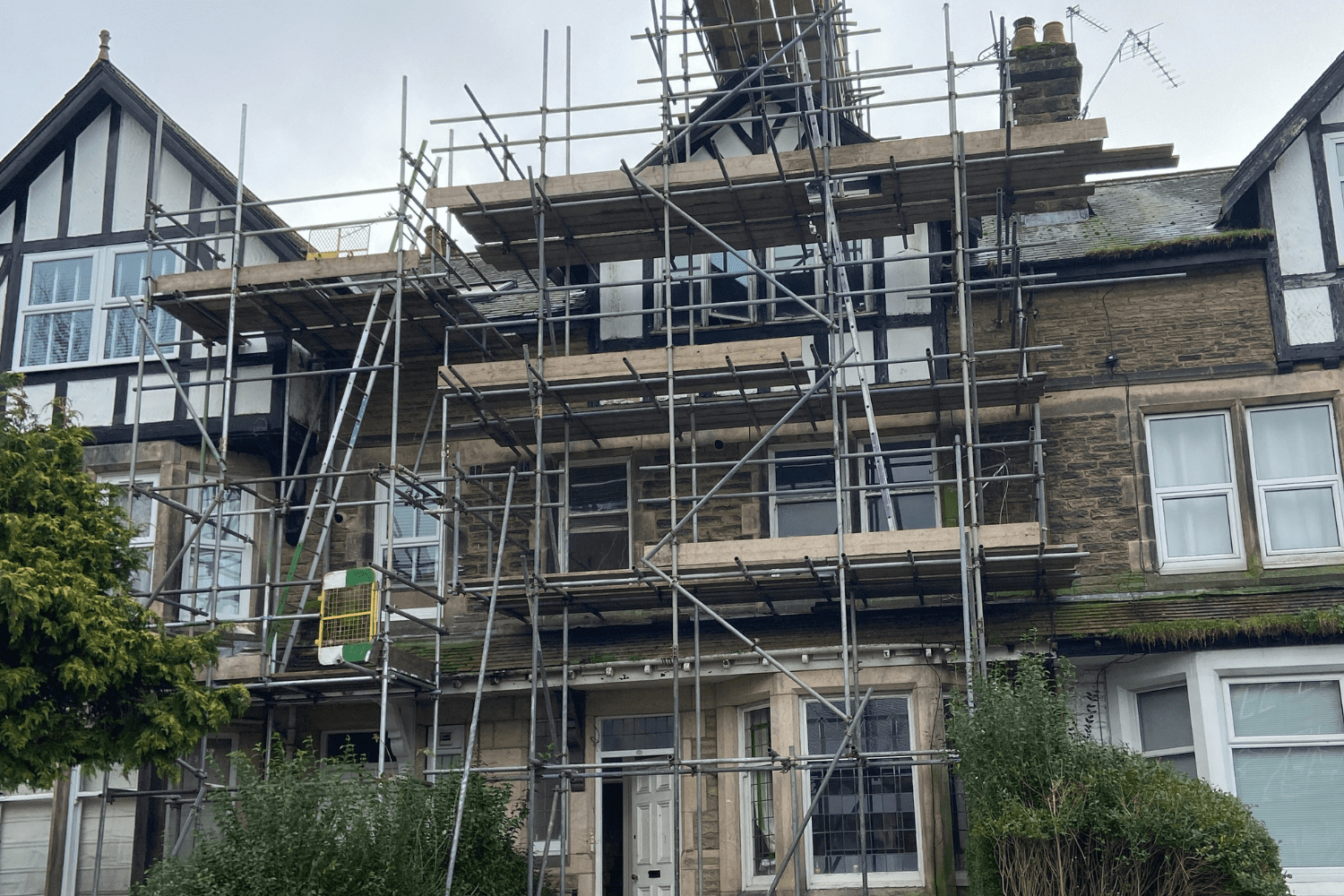

Project 2: Dragon Parade Development

Purchased in November, this property originally comprised of three apartments. Dave’s undergoing a transformation to turn it into an 8-bedroom HMO (House in Multiple Occupation), including developing the basement.

Financials:

Bought for £300,000 with a build cost of £250,000 and an expected GDV of £860,000. The project aims for a monthly gross income of approximately £6,500, with a net of around £3,000.

Keen to follow in Dave’s footsteps? You can download our prospectus to learn more about our unique franchise opportunity.